All the big corporates were once small companies with the potential to grow. However, not all small-cap companies grow big. Consequently, stock picking in this space is essential for small-cap investing due to its high risk and uncertainty.

Tata Small Cap Fund aims to identify quality small cap companies that have the potential to grow over the years. It emphasises on delivering better risk adjusted returns by focusing on stocks available at reasonable valuations in the small cap space.

Ideal for Investors:

| Scheme Name | TATA SMALL CAP FUND |

| Category of the Scheme | Small Cap Fund |

| Investment Objective | The investment objective of the scheme is to generate long term capital appreciation by predominantly investing in equity and equity related instruments of small cap companies. |

| Benchmark | Nifty Smallcap 250 TRI |

| Plan & Options | Regular Plans (Routed through Distributor) with Growth & Dividend Options. Direct Plans with Growth & Dividend Options. |

| Investment Amount | Min. Purchase Amount: 5,000 & in multiple of 1/thereafter. Min. Additional Purchase Amount: 1,000 & in multiple of 1 thereafter. Min. Redemption Amt. / Units*: 500. *There is no minimum amount requirement in case unit holder is opting for an all units switch. |

| Fund Manager | Mr. Chandraprakash Padiyar has over 21 years of experience in research and fund management. He joined Tata Asset Management as a senior fund manager (equities), in September 2018. |

| Load Structure | Entry Load: N.A. Exit Load:

|

Installments

Min. Amt

12

150/-

6

1,000/-

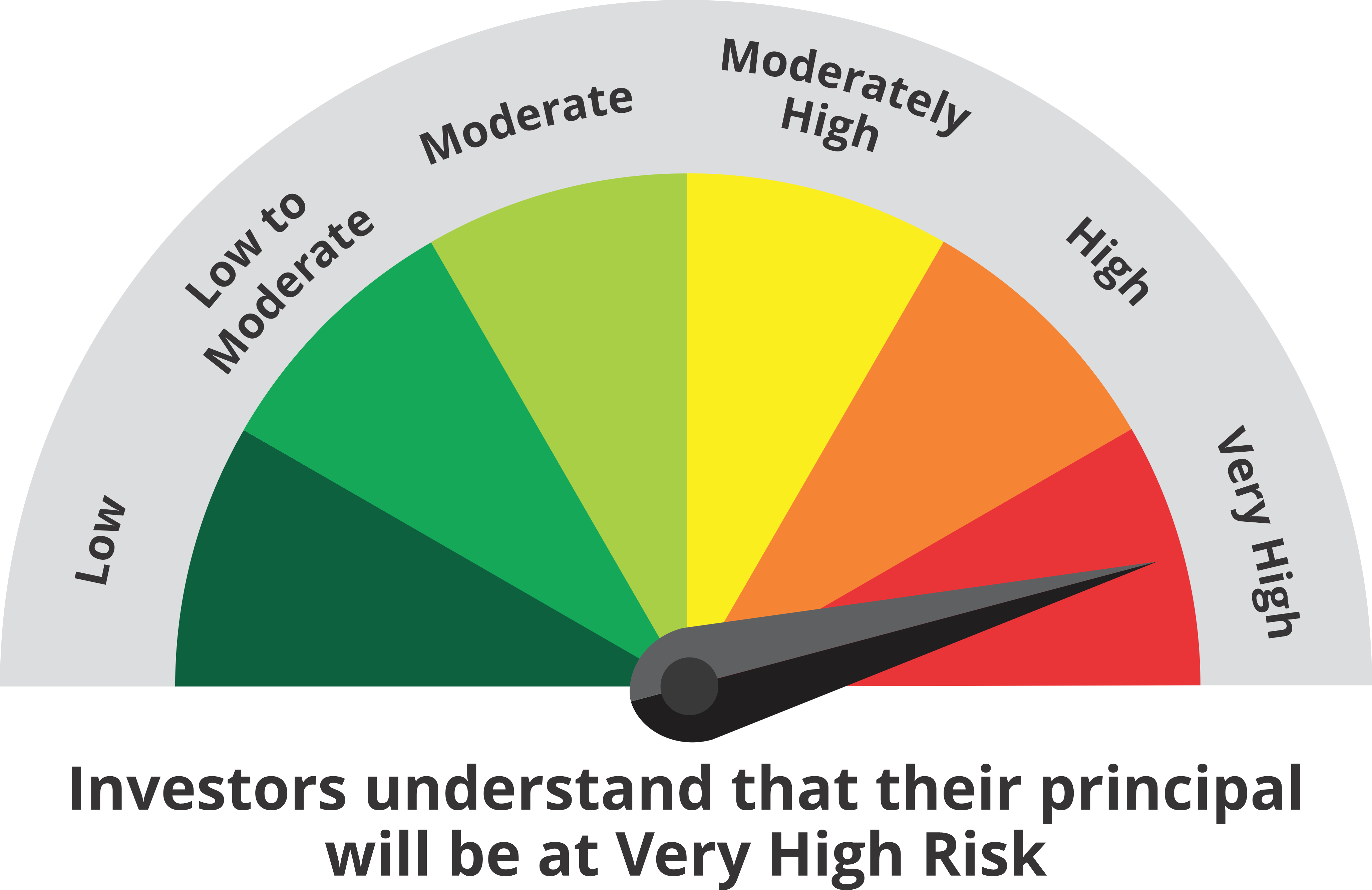

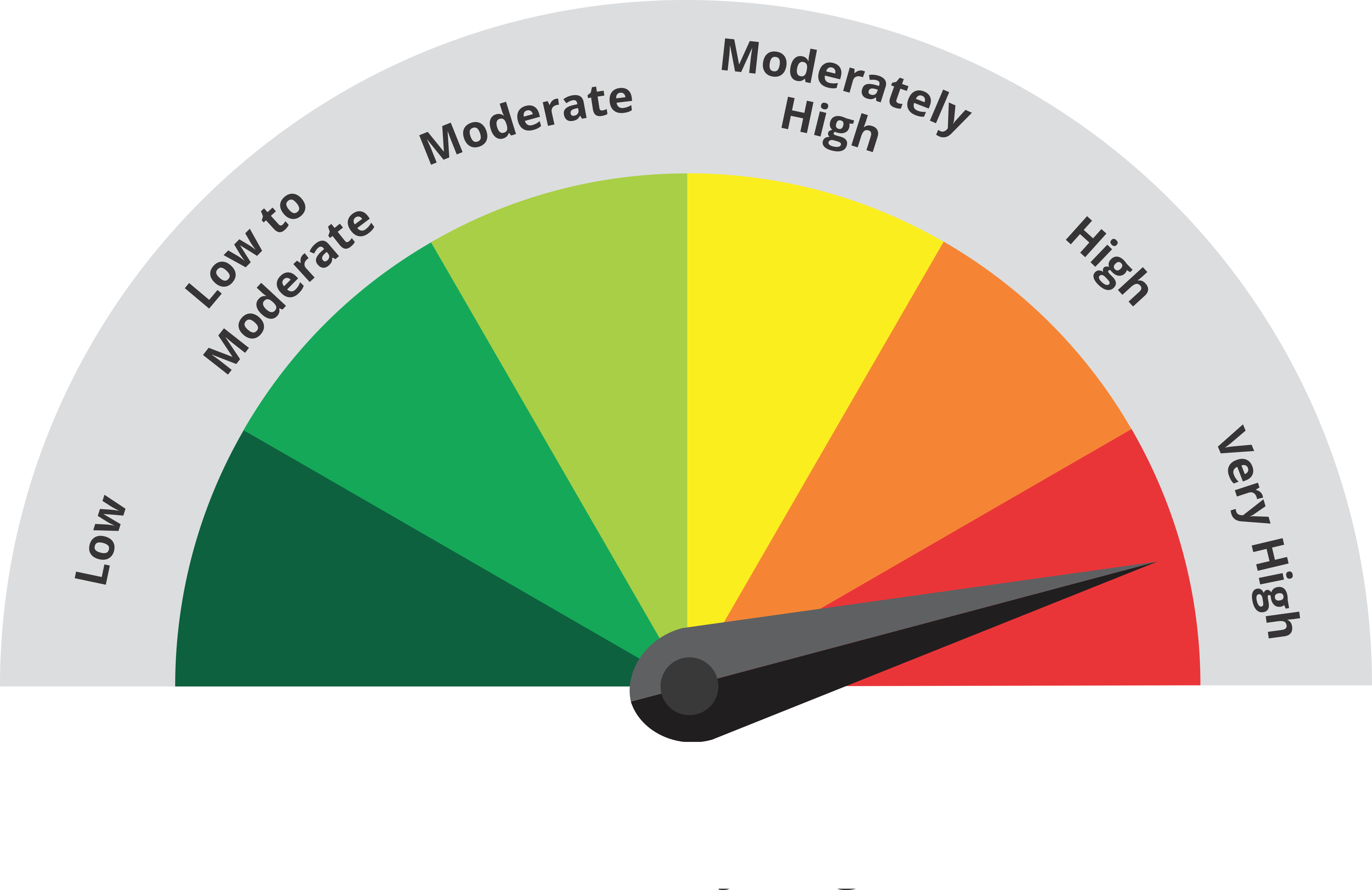

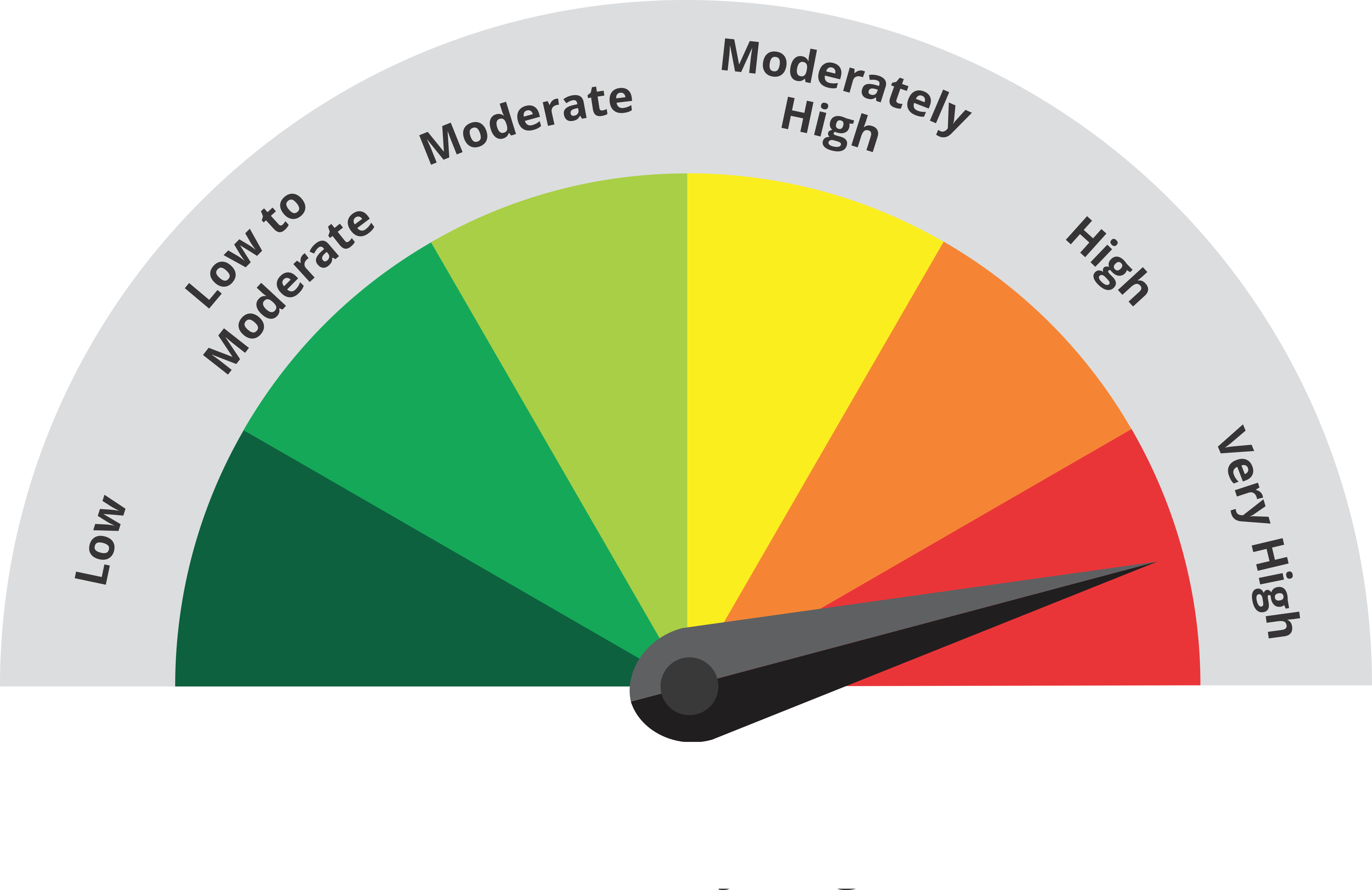

| This product is suitable for investors who are seeking*: | Scheme Risk-O-meter | Nifty Small Cap 250 TRI Index Risk O- Meter |

|

|

|

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

(It may be noted that risk-o-meter specified above is based on the scheme characteristics. The same shall be updated in accordance with provisions of SEBI circular dated October 5, 2020 on Product labelling In mutual fund schemes on ongoing basis.)

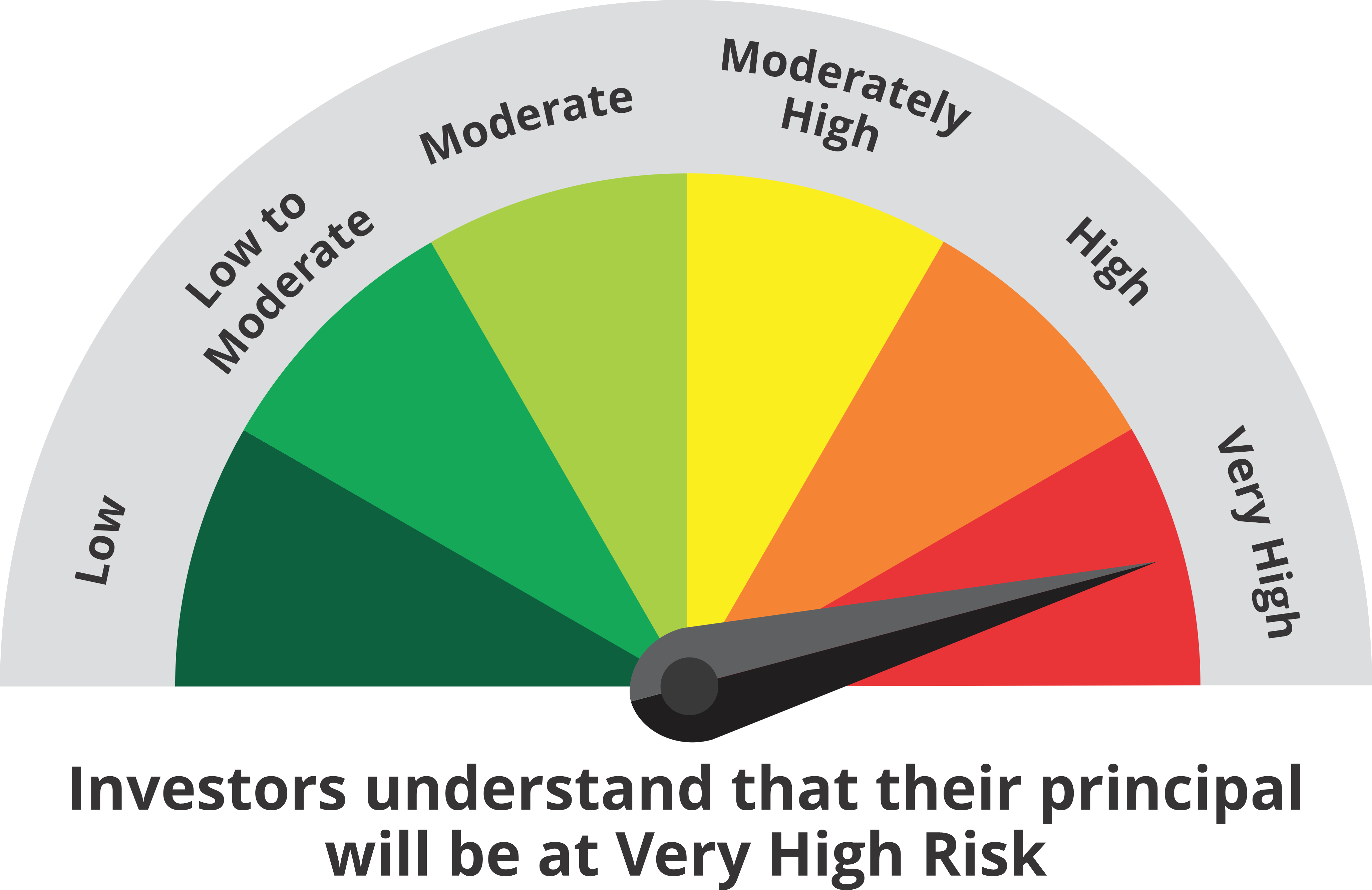

This product is suitable for investors who are seeking*:

|

Scheme Risk-O-meter

|

Nifty Small Cap 250 TRI Index Risk O- Meter

|

(It may be noted that risk-o-meter specified above is based on the scheme characteristics. The same shall be updated in accordance with provisions of SEBI circular dated October 5, 2020 on Product labelling In mutual fund schemes on ongoing basis.)

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051